AI-Driven Market Analysis in Oil Industry

In an era of unprecedented market volatility, oil companies are turning to artificial intelligence to stay ahead of the curve. This revolutionary approach is transforming how the industry adapts to fluctuations and makes critical decisions.

The Power of AI in Market Analysis

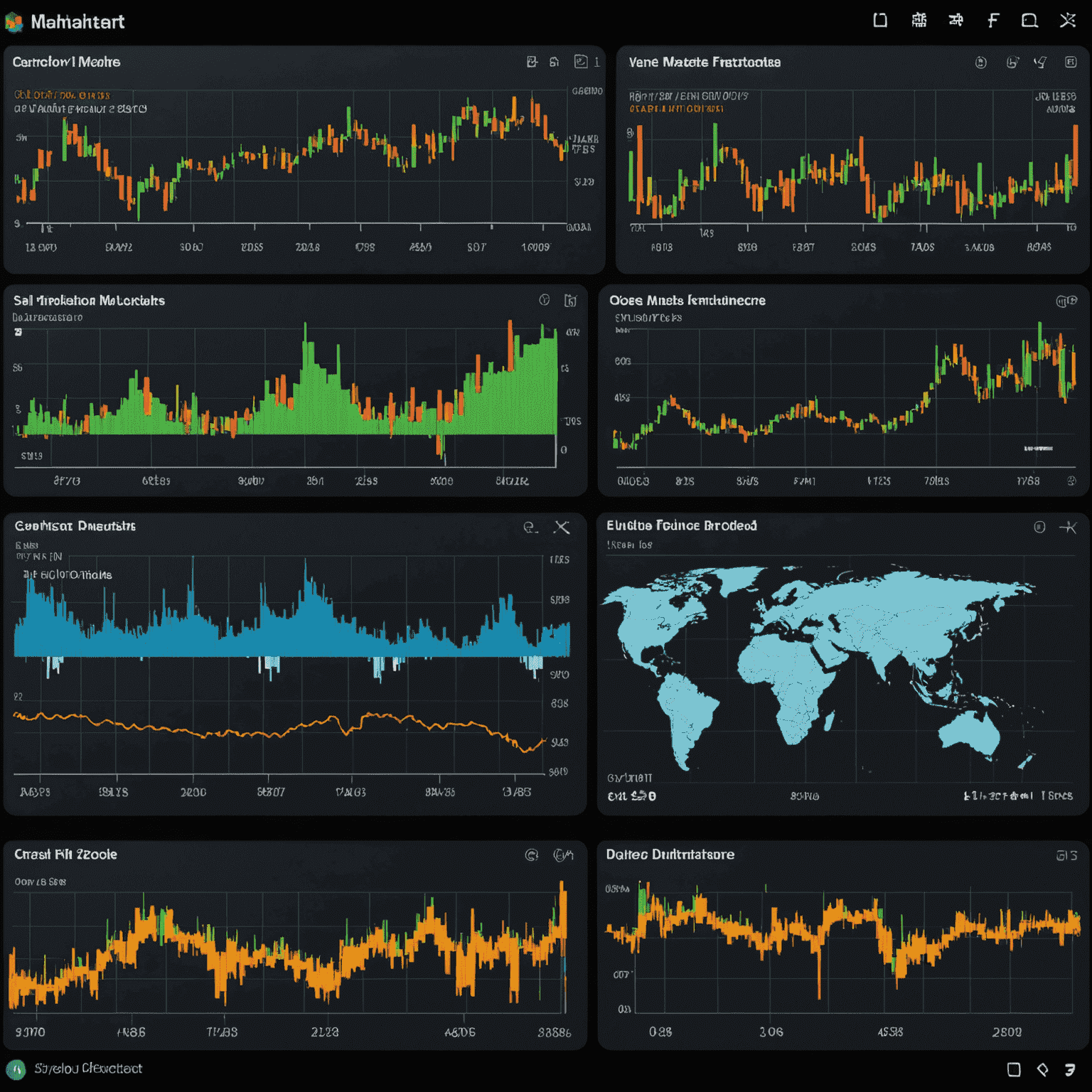

Artificial intelligence is proving to be a game-changer for oil companies seeking to implement effective anti-crisis strategies. By harnessing the power of machine learning algorithms and big data analytics, these companies can now process vast amounts of information in real-time, providing insights that were previously unattainable.

Key Benefits of AI-Driven Analysis:

- Rapid response to market changes

- Improved accuracy in demand forecasting

- Enhanced risk assessment capabilities

- Optimization of supply chain operations

- Data-driven decision making

By leveraging these AI-powered tools, oil companies can develop robust anti-crisis strategies that allow them to navigate through turbulent market conditions with greater confidence and agility.

Adapting to Market Fluctuations

The oil industry is notorious for its volatility, with prices often swinging dramatically due to geopolitical events, supply disruptions, or changes in global demand. AI systems can analyze these complex factors in real-time, providing oil companies with actionable insights to adjust their strategies swiftly.

For instance, machine learning models can predict potential supply chain disruptions by analyzing global news feeds, weather patterns, and historical data. This allows companies to proactively adjust their operations, minimizing the impact of unforeseen events on their bottom line.

Making Data-Driven Decisions

In the past, decision-making in the oil industry often relied heavily on experience and intuition. While these factors remain important, AI now provides a data-driven foundation for strategic choices. By processing and analyzing vast datasets, AI can uncover patterns and correlations that might escape human analysts, leading to more informed and objective decision-making.

Areas Where AI Enhances Decision-Making:

- Investment in new exploration projects

- Optimization of refinery operations

- Pricing strategies in volatile markets

- Environmental risk management

- Long-term strategic planning

By integrating AI into their decision-making processes, oil companies can better navigate the complexities of the global market, making choices that are both profitable and sustainable in the long term.

The Future of AI in Oil Industry Analysis

As AI technology continues to evolve, its role in market analysis for the oil industry is set to expand even further. Advanced natural language processing could allow AI systems to interpret and act on unstructured data from diverse sources, while quantum computing could revolutionize the speed and complexity of market simulations.

The integration of AI into market analysis is not just a trend, but a fundamental shift in how oil companies approach crisis management and strategic planning. As the industry continues to face challenges from market volatility, environmental concerns, and changing energy landscapes, AI-driven analysis will be crucial in developing effective anti-crisis strategies and ensuring long-term sustainability.

By embracing AI-driven market analysis, oil companies are not just adapting to change – they're staying ahead of it, turning potential crises into opportunities for growth and innovation.